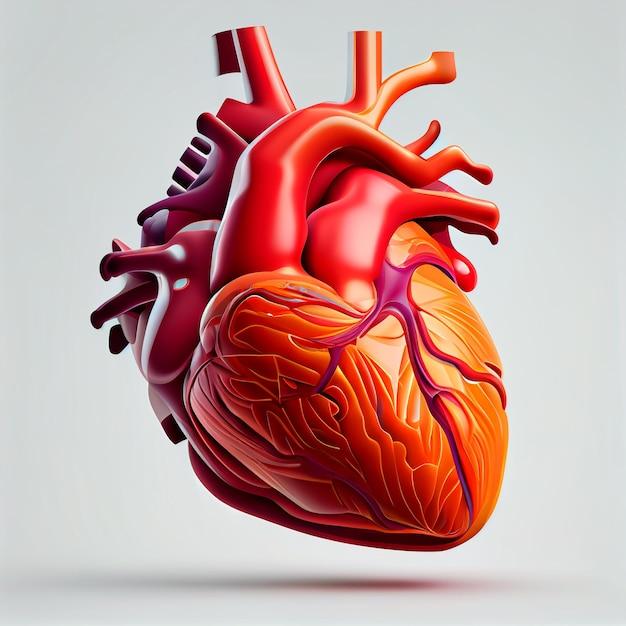

If you or someone you know has been diagnosed with cirrhosis, it’s important to understand how it can affect your ability to obtain life insurance. Cirrhosis is a serious condition that affects the liver and can be caused by a variety of factors, including alcohol abuse, hepatitis C, and non-alcoholic fatty liver disease. In this blog post, we will explore the options available to individuals with cirrhosis who are seeking life insurance coverage. We will discuss critical illness insurance, guaranteed issue life insurance, the relationship between alcoholism and life insurance, and whether or not cirrhosis qualifies as a disability. We will also address common questions such as the payout for alcohol-related deaths and the possibility of obtaining life insurance with a diagnosis of fatty liver or stage 4 cirrhosis. So, if you’re interested in learning more about life insurance options for individuals with cirrhosis, keep reading!

Life Insurance with Cirrhosis

Understanding Your Options

Living with cirrhosis can present a variety of challenges, and one of them is finding life insurance coverage. Many people worry that their pre-existing medical condition will make it impossible to secure a policy. However, it’s important to know that having cirrhosis doesn’t automatically disqualify you from obtaining life insurance. In this section, we’ll explore the options available to individuals with cirrhosis and provide insights to help you make an informed decision.

Traditional Life Insurance Policies

While it may be more challenging to obtain traditional life insurance with cirrhosis, it’s not entirely impossible. Insurance companies typically consider various factors when evaluating an applicant, and cirrhosis is just one piece of the puzzle. It’s essential to provide complete and accurate information about your medical history and current health status. This will help insurers assess your specific situation and determine the level of risk involved.

Guaranteed Issue Life Insurance

If you’re finding it difficult to secure traditional life insurance due to cirrhosis, guaranteed issue life insurance can be an option worth exploring. With guaranteed issue policies, you won’t be required to undergo a medical exam or answer health-related questions during the application process. As long as you meet the age requirements, acceptance is guaranteed. However, it’s important to note that these policies often come with higher premiums and lower coverage amounts.

Tips for Securing Life Insurance with Cirrhosis

To increase your chances of obtaining life insurance coverage with cirrhosis, consider the following tips:

Be Honest and Accurate

When applying for any life insurance policy, honesty is crucial. Provide accurate information about your medical history, including details about your cirrhosis diagnosis and any treatments you’re undergoing. By being forthright, you can avoid potential issues in the future.

Work with a Specialist

Seeking assistance from an insurance broker or specialist who is knowledgeable about high-risk cases can significantly improve your chances of finding the right life insurance coverage. These professionals can help navigate through different options and connect you with companies that have experience working with individuals with cirrhosis.

Look Beyond Traditional Insurance Companies

While well-known insurance companies may seem like the obvious choice, it’s worth exploring smaller or specialized insurers that may be more receptive to providing coverage for individuals with pre-existing conditions.

Securing life insurance with cirrhosis may require some extra effort, but it’s possible. The key is to thoroughly research your options, provide accurate information, and consider working with an expert to find a policy that meets your needs. Remember that each case is unique, so what works for one person may not be the best fit for another. By staying informed and persistent, you can find life insurance coverage that provides peace of mind for you and your loved ones.

Critical Illness Insurance

Life insurance with cirrhosis is not the only option to consider when it comes to protecting yourself and your loved ones from unexpected medical expenses. Another valuable type of insurance coverage that can provide financial support during a difficult time is critical illness insurance.

What is critical illness insurance

Critical illness insurance is a form of coverage that provides a lump sum payment in the event that you are diagnosed with a specified critical illness. These illnesses typically include major conditions such as cancer, heart attack, stroke, and kidney failure, among others. The payout from a critical illness policy can be used to cover medical expenses, make up for lost income, or even provide funds for a dream vacation.

How does critical illness insurance work

When you purchase a critical illness insurance policy, you pay a regular premium to the insurance company. If you are diagnosed with a covered illness during the policy term, you will receive a lump sum payout from the insurance company. This money is yours to use as you see fit, providing financial support when you need it most.

Why consider critical illness insurance

While life insurance with cirrhosis is an important consideration, critical illness insurance offers its own unique benefits. This type of coverage can provide financial protection even if the diagnosed illness is not life-threatening. It can help cover expenses that may not be fully covered by other insurance plans, such as deductibles, co-pays, and alternative treatments. Additionally, the lump sum payout can provide peace of mind and financial stability during challenging times.

Is critical illness insurance right for you

Deciding whether critical illness insurance is right for you depends on a variety of factors, including your budget, overall health, and family history. It is important to carefully consider your individual circumstances and consult with an insurance professional to determine the best course of action.

Life insurance with cirrhosis is certainly worth exploring, but critical illness insurance can also provide valuable protection against unexpected medical expenses. Don’t let the name scare you – critical illness insurance doesn’t have to be a serious topic. It’s a friendly, comprehensive, and hilarious way to safeguard your financial well-being. So, consider adding this type of coverage to your financial plan and bring some extra peace of mind to your life’s adventure.

Life Insurance and Alcoholism

Life insurance is an important financial tool that can provide a safety net for your loved ones in the event of your unexpected passing. However, for individuals who struggle with alcoholism, obtaining life insurance can be a bit more challenging. In this section, we will explore the relationship between alcoholism and life insurance and provide some insights and tips for those seeking coverage.

The Impact of Alcoholism on Life Insurance

Alcoholism is a serious medical condition that can have a detrimental impact on one’s health. Insurance companies generally view alcoholism as a high-risk behavior, as it can lead to various health complications such as liver cirrhosis, heart disease, and even premature death. As a result, individuals with a history of alcoholism may find it difficult to obtain traditional life insurance policies.

How Alcoholism Can Affect Life Insurance Premiums

When applying for life insurance, insurance companies typically assess an individual’s risk profile. For those with a history of alcoholism, this could mean higher premiums or even denial of coverage. Insurance underwriters carefully evaluate factors such as the severity of the alcoholism, current drinking habits, and any related health issues.

Options for Obtaining Life Insurance with Alcoholism

While securing life insurance with alcoholism may be more challenging, it is not impossible. Here are a few options to consider:

1. Sobriety Period

Demonstrating a significant period of sobriety can work in your favor when applying for life insurance. Insurance companies may look more favorably on individuals who have maintained sobriety for an extended period of time, as it suggests a higher level of control and a reduced risk of relapse.

2. Speak with an Independent Insurance Agent

Working with an independent insurance agent who specializes in high-risk cases, such as alcoholism, can be immensely helpful. These agents have extensive knowledge of the industry and can connect you with insurance companies that have more lenient underwriting guidelines for individuals with a history of alcoholism.

3. Consider a Guaranteed Issue Policy

If traditional life insurance options are not available to you due to alcoholism, a guaranteed issue policy may be a viable alternative. These policies typically require no medical exams or health questions, making them more accessible for individuals with pre-existing conditions.

4. Evaluate Your Health Status

In addition to seeking treatment and maintaining sobriety, it is crucial to manage any health issues resulting from alcoholism. Taking active steps to improve your overall health, such as receiving medical treatment and adhering to prescribed medications, can positively impact your life insurance application.

While obtaining life insurance with alcoholism may present some challenges, it is certainly attainable with the right approach. By focusing on maintaining sobriety, seeking professional help, and exploring all available options, individuals with a history of alcoholism can still secure the protection they desire for their loved ones. Remember, it is important to be honest and transparent with your life insurance application, as inaccurate disclosures can lead to coverage denials in the future.

Guaranteed Issue Life Insurance

Having cirrhosis doesn’t mean you can’t get life insurance. One option that can provide coverage regardless of your health condition is guaranteed issue life insurance. This type of policy is designed for individuals who may have difficulty getting approved for traditional life insurance due to their health conditions or other factors.

What is Guaranteed Issue Life Insurance

Guaranteed issue life insurance is a type of policy that guarantees acceptance, regardless of your health condition. Unlike traditional life insurance, you won’t be required to undergo a medical exam or answer any health-related questions. It’s a simplified way to get coverage without the hassles and the possibility of being declined.

How Does it Work

With guaranteed issue life insurance, you typically apply directly with the insurance company, either online or over the phone. The application process is quick and straightforward, with minimal documentation required. In most cases, you can get approved and start your coverage within a matter of days.

Things to Consider

While guaranteed issue life insurance is a great option for people with cirrhosis, there are a few things you should keep in mind:

-

Higher Premiums: Due to the guaranteed acceptance nature of these policies, the premiums tend to be higher compared to traditional life insurance. But for many, the peace of mind it provides is well worth the cost.

-

Lower Coverage Amounts: Guaranteed issue policies often have lower coverage amounts compared to traditional life insurance policies. However, you can still find options that provide adequate coverage to protect your loved ones in case something happens to you.

-

Waiting Period: Some policies may have a waiting period before the full death benefit is payable. This means that if you were to pass away within the waiting period (usually two to three years), the policy would typically only pay out the premiums plus interest. However, if you pass away after the waiting period, the full death benefit will be paid to your beneficiaries.

Is it Worth it

The decision to get guaranteed issue life insurance ultimately depends on your specific circumstances. If you have cirrhosis and have been declined for traditional coverage or are concerned about the medical underwriting process, guaranteed issue life insurance can be a viable option. It offers peace of mind knowing that your loved ones will have financial protection in case of your passing.

Remember, be honest and accurate when applying for any life insurance policy. While guaranteed issue policies don’t require a medical exam, providing incorrect information could result in your policy being voided or your loved ones not receiving the full death benefit. So, always read the terms and conditions carefully and consult with a licensed insurance agent to find the best possible option for you.

Alcoholic Liver Disease Insurance

Understanding Alcoholic Liver Disease

Alcoholic liver disease (ALD) is a condition that occurs due to excessive alcohol consumption over a prolonged period. It can take various forms, such as fatty liver, alcoholic hepatitis, and cirrhosis. While it’s important to acknowledge the seriousness of ALD, it’s also important to understand that life can still go on, and insurance options are available even for individuals with this condition.

Exploring Life Insurance Options

If you’re living with alcoholic liver disease and are concerned about securing life insurance, rest assured that there are options available to you. Insurance providers understand that ALD is not a death sentence and are willing to work with individuals in providing coverage.

Term Life Insurance

One possible option is term life insurance. This type of insurance provides coverage for a specific period, typically 10, 20, or 30 years. While the premiums may be higher for individuals with ALD, obtaining term life insurance can provide financial security for your loved ones in the event of your passing during the term of the policy.

Guaranteed Issue Life Insurance

Another option to consider is guaranteed issue life insurance. This type of insurance does not require a medical exam or a review of your health history. As long as you meet the age requirements, you can get approved for coverage. Keep in mind that the coverage amount may be limited, and the premiums may be higher compared to other types of life insurance policies.

Seeking Professional Help

Navigating the world of life insurance can be overwhelming, especially when you have a pre-existing condition like alcoholic liver disease. That’s why it’s important to seek the assistance of an experienced insurance agent or broker specializing in high-risk cases. They can help you understand your options, compare quotes, and find the best policy that suits your needs and budget.

The Importance of Honesty

When applying for life insurance with alcoholic liver disease, honesty is crucial. Providing accurate information about your condition can help insurance providers assess your application properly. Concealing your condition may result in the denial of your claim in the future. It’s always best to be upfront about your health and work with insurance professionals who understand and empathize with your situation.

In conclusion, obtaining life insurance with alcoholic liver disease may require some extra effort, but it is not impossible. By exploring different types of insurance policies, seeking professional guidance, and being honest about your condition, you can find the coverage you need to protect your loved ones and gain peace of mind. Remember, life goes on, and so should your pursuit of financial stability and security.

Accidental Death Insurance and Alcohol

Accidents can happen to anyone, especially when alcohol is involved. While we don’t want to rain on your parade, it’s important to consider how alcohol use may impact your eligibility for accidental death insurance. So grab a drink (non-alcoholic, of course) and let’s dive into this important topic.

Understanding Accidental Death Insurance

Accidental death insurance is a type of coverage that provides financial protection to your loved ones in the event of your untimely demise due to an accident. It’s essentially a safety net to help your family during a difficult time. However, when it comes to alcohol consumption, things can get a bit tricky.

The Influence of Alcohol

Alcohol and accidents often go hand in hand. Whether it’s slipping on a drink spill or making poor decisions behind the wheel, the effects of alcohol can increase the risk of accidents. Insurance companies take note of this correlation and may adjust their policies accordingly.

Impact on Policy Eligibility

Now, let’s cut to the chase: can you get accidental death insurance if you consume alcohol? The answer is, it depends. Each insurance provider has its own criteria, and factors such as the frequency and amount of alcohol consumed may be taken into consideration.

The Dreaded Underwriting Process

When applying for accidental death insurance, you’ll likely go through an underwriting process. During this process, the insurance company evaluates your risk profile by considering various factors, including your alcohol consumption habits. While enjoying a social drink or two isn’t likely to raise any eyebrows, a history of excessive alcohol use or a diagnosis of alcoholism could impact your eligibility.

Be Honest, Stay Covered

To navigate the murky waters of insurance, honesty is key. It’s important to disclose your alcohol consumption truthfully in your application. Attempting to hide or downplay your alcohol consumption may lead to severe consequences, including a denied claim or even policy cancellation.

Finding the Right Fit

If you have a history of alcohol consumption, don’t panic just yet. Some insurance providers specialize in offering coverage for those who may face increased risks, such as individuals with medical conditions or lifestyle choices like regular alcohol use. Shopping around and consulting with an insurance professional can help you find the right fit for your needs.

Responsible Drinking and Safety First

Of course, the best course of action is always to prioritize responsible drinking and safety. Taking precautions, such as using designated drivers or avoiding excessive alcohol consumption, can lower the risk of accidents and make the underwriting process smoother.

When it comes to accidental death insurance and alcohol, it’s essential to be informed and upfront about your alcohol consumption. While it’s not impossible to get coverage, understanding the potential impact on your eligibility and taking steps to mitigate risk is crucial. So, let’s raise a glass to responsible drinking and ensuring financial protection for our loved ones in case of the unexpected. Cheers!

Will Life Insurance Pay Out for Alcoholism

So you’re thinking about life insurance, huh? That’s a smart move! It’s all about protecting your loved ones when you’re no longer around. But what happens if you’ve been battling alcoholism? Will life insurance still pay out? Let’s dive into that question.

Understanding the Fine Print

Life insurance providers are typically concerned about the risks they undertake when offering coverage. This means they will carefully assess your situation before making a decision. For those with a history of alcoholism, things can get a bit tricky.

Alcoholism and Life Insurance

First things first, it’s important to mention that every individual case is different. While some life insurance companies might outright deny coverage for alcoholics, others might be more willing to provide it. Here’s a general breakdown of how they evaluate the situation:

1. Length of Sobriety

Life insurance providers will take your length of sobriety into consideration. If you’ve conquered your alcohol demons and have been sober for an extended period, your chances of getting coverage are significantly higher.

2. Medical Reports and Records

Be prepared for the insurance company to request medical reports and records regarding your alcoholism treatment. They want to see that you’ve taken steps to address the issue and have been following a treatment plan.

3. Current Health Condition

Insurance providers will also look at your current health condition to gauge the potential risk. If your liver shows signs of cirrhosis or other alcohol-related complications, you may face more challenges in securing coverage. It’s essential to be honest and transparent with all your health details during the application process.

4. Cost and Terms

Even if you manage to secure life insurance, keep in mind that the cost and terms may differ from those offered to individuals without a history of alcoholism. You might face higher premiums or exclusions related to alcohol-related deaths.

5. Seek Professional Advice

Navigating the world of life insurance with a history of alcoholism can be overwhelming. Consider consulting with an insurance broker who can help you find a policy that works best for your circumstances.

While life insurance coverage for individuals with a history of alcoholism can be challenging, it isn’t impossible. By demonstrating your commitment to sobriety and being honest with insurance providers, you give yourself a better chance of securing coverage. Remember, the goal is to protect your loved ones, so explore all your options and find the best fit for your needs.

Is Liver Cirrhosis Classified as a Disability

Living with liver cirrhosis can present numerous challenges, and it’s natural to wonder whether it qualifies as a disability. Let’s delve into this topic and see how the classification works.

Understanding Disability and Liver Cirrhosis

Liver cirrhosis is a chronic condition that affects the liver’s ability to function properly. It occurs when healthy liver tissue is replaced with scar tissue, leading to impaired liver function. While liver cirrhosis can cause significant health issues, whether it is classified as a disability depends on various factors.

Social Security Disability Insurance (SSDI) and Liver Cirrhosis

When it comes to government assistance, the Social Security Administration (SSA) provides Social Security Disability Insurance (SSDI). To qualify for SSDI benefits, you must have a medically determinable impairment that prevents you from engaging in substantial gainful activity (SGA) for at least 12 consecutive months.

Meeting the Eligibility Criteria

To be considered eligible for SSDI benefits due to liver cirrhosis, it must significantly impact your daily activities and the ability to work. The SSA evaluates factors such as physical limitations, symptoms, the effectiveness of treatment, and medical evidence to determine whether an individual qualifies as disabled.

The Listing of Impairments

The SSA has a Listing of Impairments, also known as the Blue Book, which outlines impairments that can potentially qualify as disabilities. Liver cirrhosis falls under Section 5.05, Chronic Liver Disease. Meeting the specific criteria in this listing can strengthen your case for disability benefits.

Alternative Approaches

Even if you don’t meet the specific criteria in the Blue Book, you might still be eligible for benefits. The SSA acknowledges that other factors affecting your ability to work, such as age, education, and work history, should also be considered. This allows for a more individualized assessment of your disability claim.

Seeking Professional Assistance

Navigating the disability application process can be complex, and hiring an experienced attorney or advocate specializing in disability claims can greatly improve your chances of a successful outcome. They can guide you through the process, gather necessary medical evidence, and present a strong case on your behalf.

Wrapping Up

While liver cirrhosis can cause significant health challenges, whether it is considered a disability depends on various factors. Understanding the eligibility criteria and seeking professional assistance can help you determine your options and improve your chances of obtaining the benefits you need. Remember, having a supportive team and a comprehensive understanding of the process can make all the difference.

Life Insurance Payout for Alcohol-Related Death

While life insurance is designed to provide financial support to your loved ones after your passing, there are certain circumstances that may affect the payout, such as an alcohol-related death. Understanding how life insurance policies handle these situations is crucial. In this section, we’ll delve into the ins and outs of life insurance payouts for alcohol-related deaths, giving you the information you need to make informed decisions.

Alcohol and Life Insurance: A Delicate Combination

Alcohol consumption is a common part of many people’s lives, but excessive drinking can lead to serious health issues, including cirrhosis. Unfortunately, this condition can be fatal, raising concerns about whether life insurance policies cover deaths related to alcohol.

Policy Specifics and Exclusions

When it comes to life insurance, policy specifics and exclusions vary among providers. Some policies may contain clauses excluding coverage for deaths caused directly by alcohol-related liver disease or excessive alcohol consumption. It’s crucial to carefully review your policy documents to have a clear understanding of its terms and conditions.

Medical History and Underwriting Process

As with any life insurance application, the underwriting process plays a significant role in determining your eligibility and premium rates. When disclosing your medical history, it’s essential to provide accurate information about your alcohol consumption and any related health issues, such as cirrhosis. Honesty is key to ensure you receive an appropriate and fair assessment of your insurance application.

Considerations for High-Risk Individuals

Obtaining life insurance with a history of cirrhosis can be challenging, but not impossible. Some insurers specialize in providing coverage for high-risk individuals, including those with alcohol-related conditions. These companies may tailor their policies to meet the specific needs of individuals with cirrhosis, ensuring that their loved ones receive adequate financial protection.

Working with an Insurance Advisor

Navigating the world of life insurance can be overwhelming, especially when dealing with alcohol-related health issues. Seeking guidance from an insurance advisor can help you make informed decisions regarding your life insurance options. They can provide personalized advice, identify insurers that specialize in covering high-risk individuals, and assist you throughout the application process.

In conclusion, life insurance coverage for alcohol-related deaths can be complex, with policies varying among providers. Disclosing accurate information, understanding policy terms and exclusions, and working with an insurance advisor are crucial steps toward securing the right coverage in such circumstances. Remember, protecting your loved ones’ financial well-being is always worth the effort.

Can You Still Get Life Insurance with Fatty Liver

Life insurance is a crucial financial protection that many individuals seek to secure for themselves and their loved ones. However, when a medical condition like fatty liver is present, potential policyholders often wonder if they can still obtain coverage. In this subsection, we’ll take a closer look at whether individuals with fatty liver can get life insurance and what factors may come into play.

The impact of fatty liver on life insurance applications

Fatty liver, also known as hepatic steatosis, is a condition characterized by the accumulation of fat in the liver cells. It can be caused by various factors, such as obesity, alcohol abuse, or certain medications. When applying for life insurance with fatty liver, insurance providers typically consider the severity and underlying cause of the condition.

Underwriting considerations

- Medical history: Insurance underwriters will review your medical history, including any diagnoses related to fatty liver, such as non-alcoholic fatty liver disease (NAFLD). They may also inquire about your lifestyle, alcohol consumption, and any relevant medications.

- Liver function tests: Underwriters may request recent liver function test results to assess the severity and progression of the condition. Elevated liver enzymes could indicate more significant liver damage.

- Additional medical conditions: Fatty liver is often associated with other health conditions, such as obesity, diabetes, or high cholesterol. These comorbidities are also taken into account during the underwriting process.

Types of life insurance coverage to consider

- Fully Underwritten Life Insurance: This traditional type of life insurance requires a comprehensive medical examination, including blood tests and a review of medical records. Fatty liver may influence the premium rates or lead to a higher risk classification.

- Simplified Issue Life Insurance: As a simplified alternative to fully underwritten policies, this type of coverage typically involves a shorter application process with no medical exam. Although it may seem more accessible for individuals with fatty liver, premium rates may be slightly higher.

- Guaranteed Issue Life Insurance: This type of coverage guarantees acceptance without requiring a medical exam or health questionnaires. It can be an option for those with severe fatty liver or other chronic medical conditions, but the initial death benefit may be limited during the first few years.

Supportive measures to increase your chances

- Medical treatment: Following your healthcare provider’s recommendations for managing fatty liver, such as lifestyle changes or medications, can demonstrate your commitment to controlling the condition.

- Maintaining a healthy lifestyle: Engaging in regular exercise, maintaining a balanced diet, limiting alcohol consumption, and managing related medical conditions can positively influence your application.

Navigating the life insurance application process with fatty liver may require some extra effort, but it is often still possible to obtain coverage. Keep in mind that each insurance company follows its own underwriting guidelines, so it may be beneficial to seek quotes from multiple providers to find the best fit for your circumstances. Remember, even with fatty liver, life insurance can offer valuable peace of mind for you and your loved ones.

Does Stage 4 Cirrhosis Qualify for Disability

Understanding the Qualification Process

Living with stage 4 cirrhosis can affect many aspects of your life, including your ability to work and earn a living. In some cases, individuals with advanced cirrhosis may be eligible for disability benefits. However, the qualification process for disability can be complex and challenging to navigate.

Evaluating the Severity of Cirrhosis

When determining disability eligibility, the Social Security Administration (SSA) uses a five-step evaluation process. This process assesses the severity of your condition, your ability to perform work-related activities, and whether you meet their definition of disability.

Step 1: Meeting the Basic Requirements

To be considered, your cirrhosis must be expected to result in death, or it must have lasted or be expected to last for a continuous period of at least 12 months.

Step 2: Meeting the Medical Criteria

The SSA has a specific listing called “Chronic Liver Disease,” which includes cirrhosis. To meet this listing, your medical records must show certain criteria, such as abnormal liver function, complications from portal hypertension, or a need for a liver transplant.

Step 3: Assessing the Ability to Perform Work Activities

If you don’t meet the specific medical criteria outlined by the SSA, they will assess your ability to perform work activities. They will evaluate if your cirrhosis limits your physical or mental functioning to the extent that you cannot do any work you have previously done or adjust to other types of work.

Step 4: Considering Past Work Experience

The SSA will consider your previous work experience and determine whether you can adapt to different types of work with your limitations. They will assess your age, education, skills, and work experience to determine if you are still eligible for disability benefits.

Step 5: Assessing Disability Eligibility

If you cannot perform any substantial gainful activity due to your cirrhosis-related limitations and you meet all other requirements, the SSA may consider you disabled and eligible for benefits.

The Importance of Gathering Comprehensive Documentation

To increase your chances of successfully qualifying for disability benefits with stage 4 cirrhosis, it is crucial to gather comprehensive documentation. This may include medical records, lab results, imaging studies, and statements from your healthcare team. Providing a comprehensive overview of your condition will strengthen your case and help the SSA understand the full extent of your limitations.

Seeking Professional Assistance

Given the complexity of the disability qualification process, it may be beneficial to seek professional assistance. Social Security disability lawyers or representatives specialize in guiding individuals through the application process and improving their chances of a successful outcome.

Remember, each case is unique, and the SSA evaluates disability claims on an individual basis. It’s essential to consult with a professional and obtain personalized advice based on your circumstances.

By understanding the qualification process and gathering compelling documentation, you can navigate the disability application process with confidence and increase your chances of receiving the support you need.

Can I Get Life Insurance with Cirrhosis of the Liver

Living with cirrhosis of the liver can be challenging, but it doesn’t mean you have to give up on getting life insurance. Many people worry that their health condition will prevent them from getting coverage, but the good news is that there are options available. In this article, we’ll explore the possibility of obtaining life insurance with cirrhosis and what you need to know before applying.

Understanding Cirrhosis and its Impact on Life Insurance

Cirrhosis is a serious condition that occurs when healthy liver tissue is replaced with scar tissue. This scarring can lead to liver dysfunction and various health complications. Insurers will take into consideration the severity of your condition, any underlying causes, and your overall health when evaluating your application for life insurance.

Working with an Experienced Agent

When you have cirrhosis, it’s essential to work with an experienced insurance agent who specializes in high-risk cases. They can guide you through the application process, understand your unique needs, and help you find suitable coverage options. An experienced agent will have the necessary knowledge to navigate the complexities of underwriting and negotiate on your behalf.

Types of Life Insurance Available

There are different types of life insurance policies you can consider when living with cirrhosis.

-

Term Life Insurance: Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years. This type of policy may be more accessible to individuals with cirrhosis who are in relatively stable health conditions.

-

Guaranteed Issue Life Insurance: Guaranteed issue life insurance does not require a medical examination or health questionnaire. It offers coverage regardless of your health status. While this type of insurance may be easier to obtain, it typically has a lower coverage amount and higher premiums.

-

Simplified Issue Life Insurance: Simplified issue life insurance is a middle ground between term and guaranteed issue policies. It requires a simplified health questionnaire but no medical exam. The coverage amount is generally higher than guaranteed issue policies, but premiums may still be slightly higher than for those in excellent health.

Factors to Consider

When looking for life insurance with cirrhosis, several factors will influence your eligibility and terms:

-

Medical records: The insurance company will review your medical records to assess the severity and progression of your cirrhosis. It’s crucial to have accurate and up-to-date documentation.

-

Stability of your condition: Stable liver function, good overall health, and adherence to treatment plans can increase your chances of obtaining coverage and may even lead to better rates.

-

Smoking and alcohol consumption: If you have cirrhosis, it’s essential to quit smoking and limit alcohol consumption. Smoking and alcohol can exacerbate liver damage and negatively impact your insurance application.

-

Financial planning: Before applying for life insurance, consider your long-term financial goals and how the policy will fit into your overall financial plan. This includes evaluating the coverage amount you need to protect your loved ones adequately.

While getting life insurance with cirrhosis of the liver may present some challenges, it’s not impossible. By working with an experienced agent, exploring different policy types, and considering essential factors, you can find coverage that meets your needs. Remember, even if you encounter difficulties, don’t give up. There are options out there, and protection for you and your loved ones is possible.